Dear friends,

Welcome to the September (aka “back to school”) issue of the Mutual Fund Observer. The joyful tumult of which has slightly delayed our launch.

Despair is easy. If you ever want an antidote, drop by Augie at the beginning of September. As many of you know, in my day job, I am a professor of communication studies and director of the Austin E Knowlton Honors Program at Augustana College. I am also an advisor to first-year students. I’ve spent much of the last week meeting with and learning about my new charges. I am amazed by them, defying as they do all of the hysterical media headlines about entitled brats using college to polish their social media profile.

Pfeh.

We’re welcoming 766 new Vikings, including 171 international students (we now have representatives from more countries than US states which is incredibly cool because when I first taught at Augie our international student population were three Swansons and a Johnson, all from Sweden), 162 US students of color and 80 transfers. 42% of our kids are eligible for Federal Pell grants, which are available only to low-income families. (Chip, whose community college students have even more modest backgrounds than ours, fumed briefly at a recent New York Times article about the rise of interior decorators who specialize in dorm room décor at about $10,000 a pop. Dear Lord. Not here. Think: Target.) As we talked I learned that Alonso, from Arequipa, Peru, has been reading the works of Nazi propaganda minister Joseph Goebbels in German for a year-long high school project. Aji, from Nairobi, Kenya, chatted happily about studying in Seoul, South Korea. Collectively their aspirations range from becoming pediatric surgeons to speech pathologists. They are funny, brave and scared.

What more about any of us hope for?

In this month’s issue of MFO …

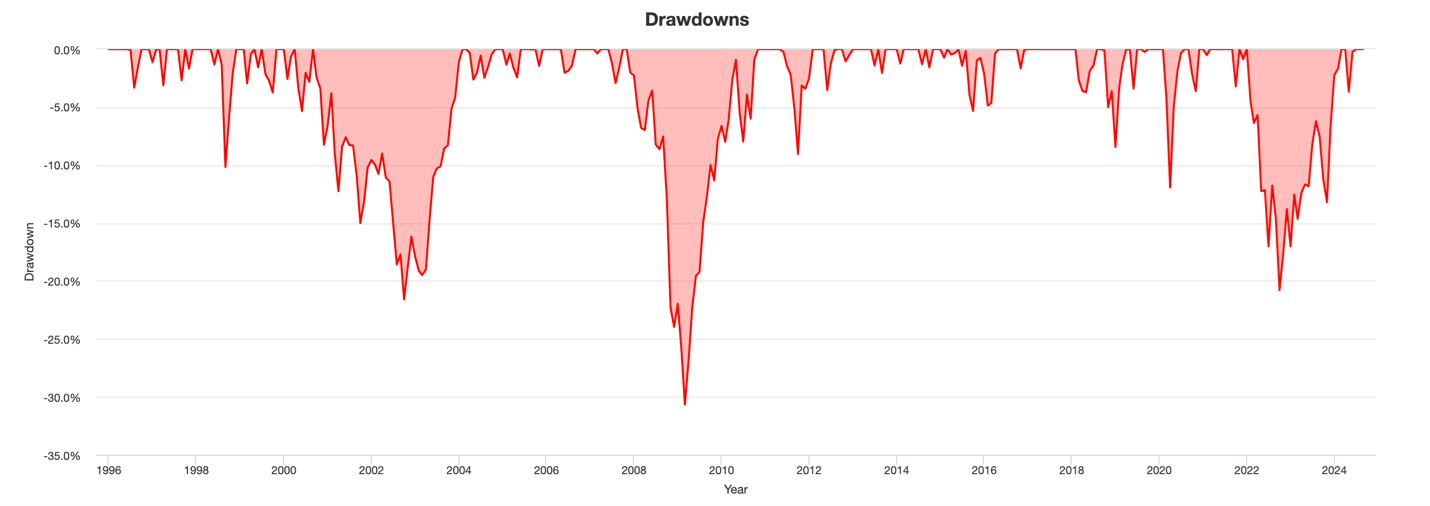

In penance for an article about my portfolio in BottomLine: Personal (“The Lazy Man’s Mutual Fund Portfolio: For Both Good Times and Bad,” 9/1/2024), I propose two two-fund portfolios appropriate for small investors looking to get started without looking to babysit. My own portfolio as outlined in the BottomLine article, is designed, in part, as a tool to help me track a range of interesting possibilities but, at 10 funds, it’s far more sprawling than necessary. I try to correct that by creating two low-risk, flexible portfolios to meet the needs of sensible younger investors through FPA, Intrepid, Leuthold, and RiverPark funds.

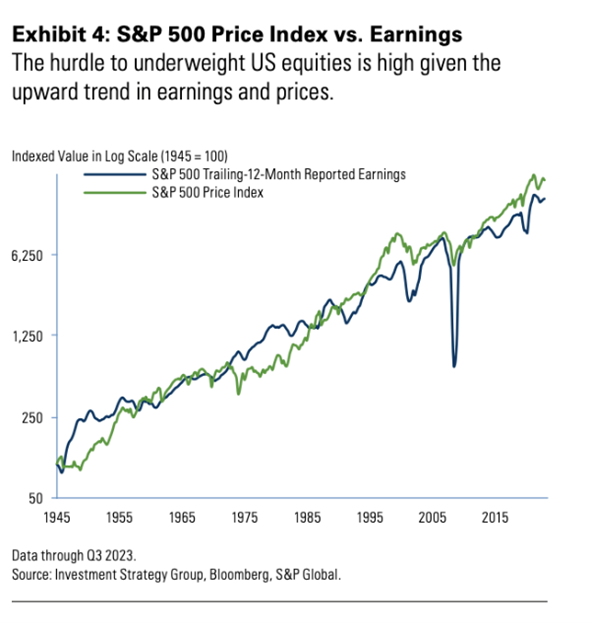

In celebration of Warren Buffett’s 94th birthday, our colleague Devesh Shah surveys the maelstrom and guides you through it to a Buffett-like conclusion: “meh, maybe a tweak or two, then off to McDonald’s for dinner!”

Charles will walk through a useful new feature at MFO Premium: ETF Benchmarks. We now offer the data to guide all those people who ask, “Wouldn’t I be better off just buying an ETF or ten?”

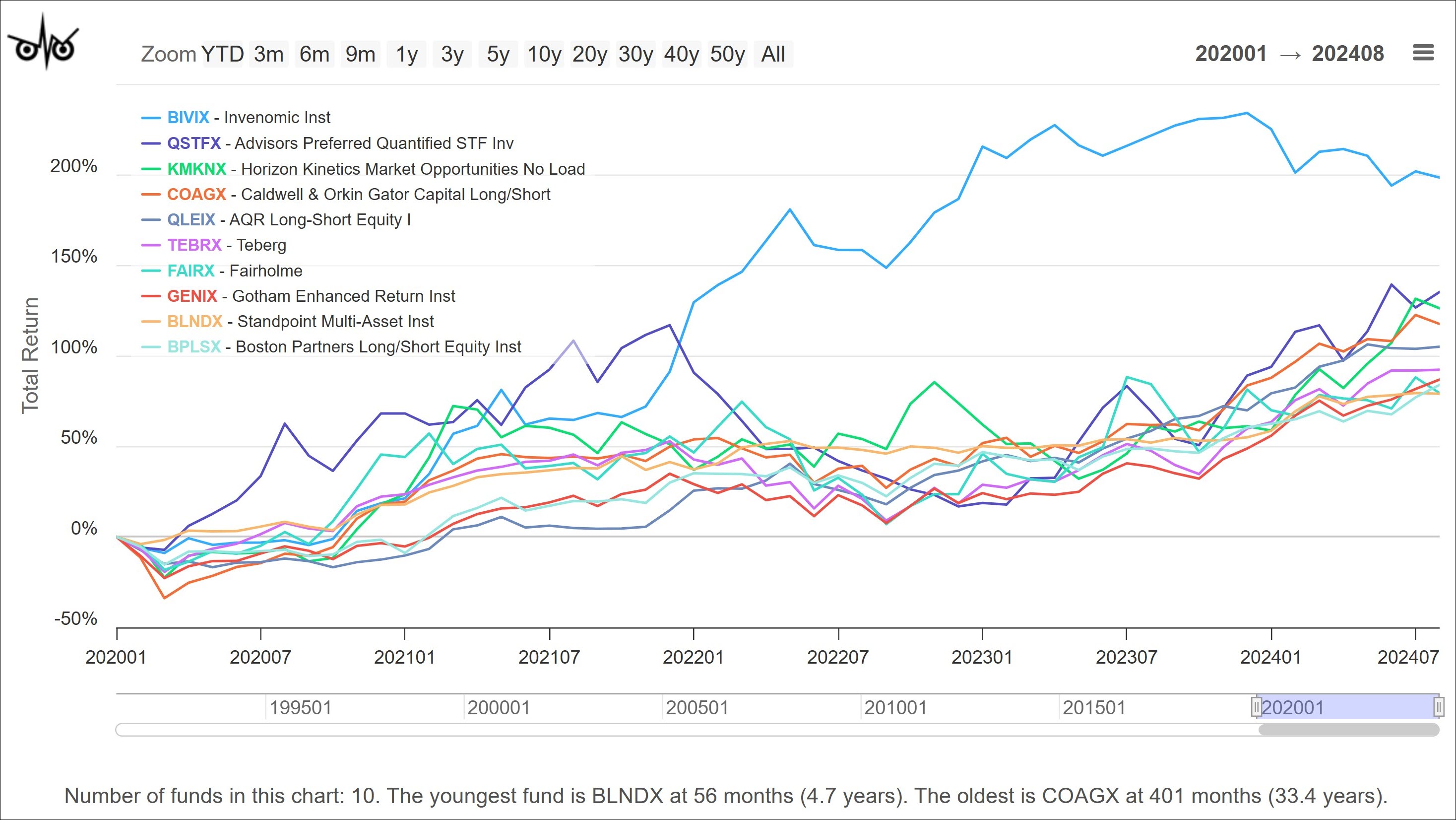

We also present our first near-Launch Alert, for Research Affiliates Deletions ETF. It is RAFI’s first fund marketed under their own brand and it targets an interesting and persistent market anomaly: companies booted out of cap-weighted indexes tend to enjoy a five-year run of success following their deletion. There’s a bunch of research and a bunch of possible reasons, including the fact that such firms tend to be small-cap value, they benefit from regression to the mean, and they were booted after the worst of their troubles were behind them. RAFI is talking about the fund today and you’ll be able to buy it in a week.

The Shadow, as ever, documents the industry’s developments, both its brilliance and its occasional cowardice, in Briefly Noted.

Ben Carlson: assuming the world goes to hell, your portfolio …

…will probably make about 10%.

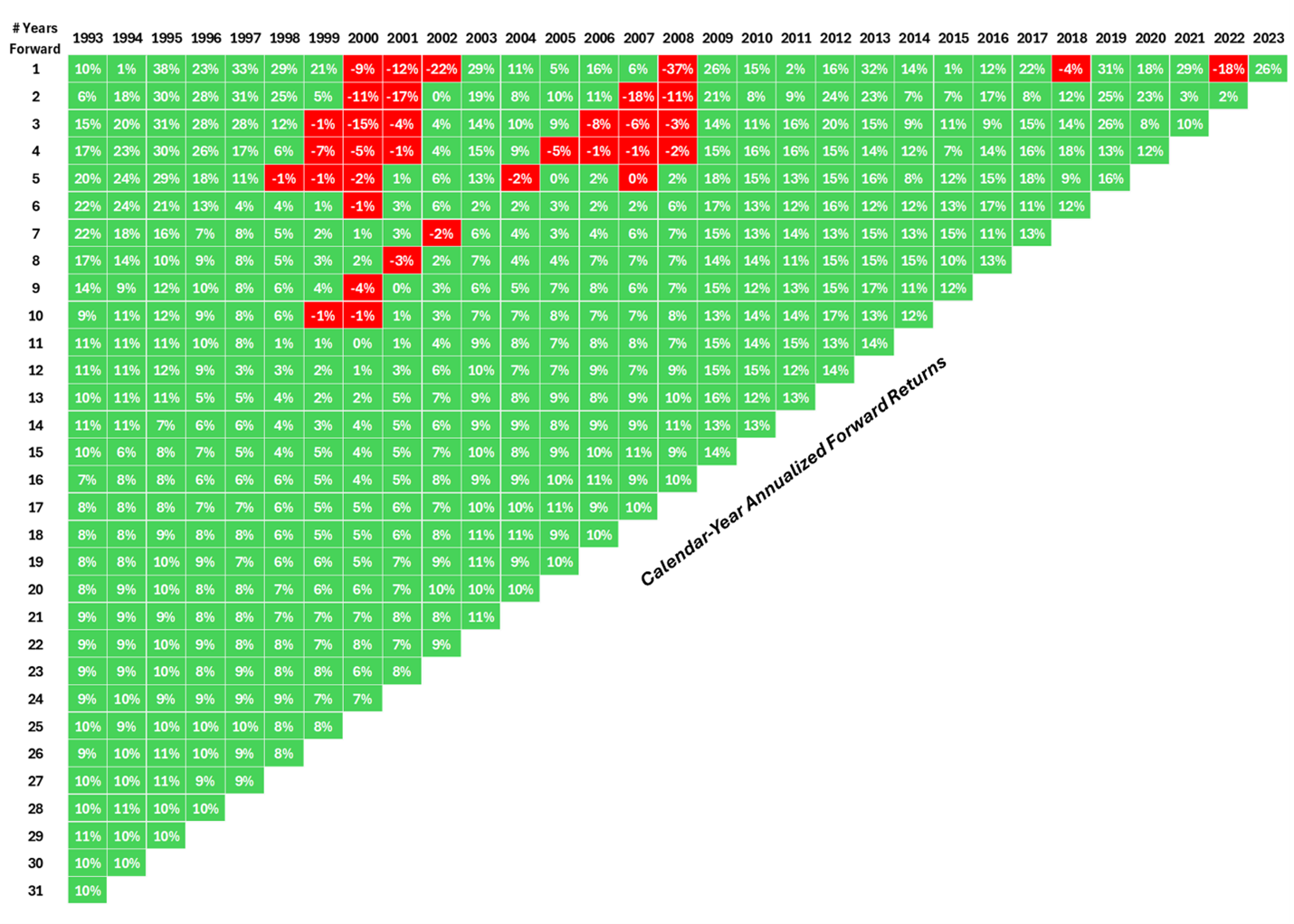

Mr. Carlson, who manages portfolios for institutions and individuals at Ritholtz Wealth Management LLC, writes the exceptional Wealth of Common Sense blog. In this month’s entry, he addresses our universal jitters about the stock market by looking at … the stock market. In particular, he calculated the average annual returns for investments made in each of the past 30 years.

So, for example, if you look at the column labeled 2000 – a largely sucky year in the market – then the row labeled 15, you’d see that a particularly poorly timed investment made in 2000 would have returned about 4% annually over the following 15 years. Sad, but not an apocalypse.

His greatest optimism comes from reading along the jagged edge: the long-term returns for every investment period. “The 31-year annual return from 1993 through 2023 was around 10% per year, right at the long-term averages.” That despite:

An emerging markets currency crisis in 1998, the Long-Term Capital Management blow-up, the dot-com bubble, 9/11, the housing bubble, the Great Financial Crisis, the European Debt Crisis, the pandemic, and the highest inflationary spike in four decades.

We also sprinkled in a few recessions, two massive market crashes, two bear markets, and ten double-digit corrections.

His recommendation, which tracks ours: “Regardless of what returns the stock market produces in the future, thinking and acting for the long-term remains the most sane strategy for investors.”

Buy quality. Hold quality. Get on with life!

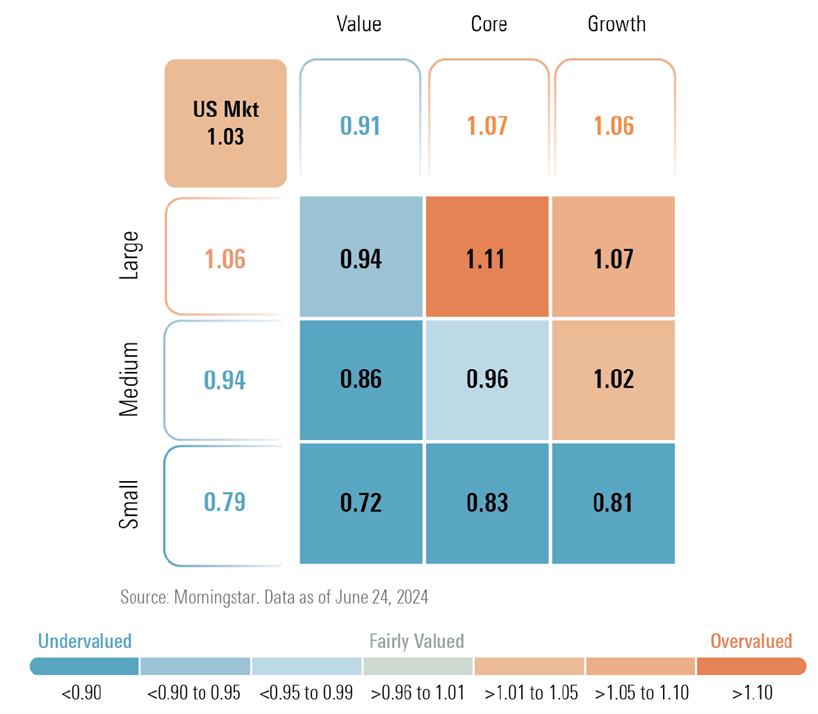

Morningstar: It’s time to consider US large cap value, US small caps and emerging markets

Bryan Armour, director of passive strategies research for North America and editor of Morningstar ETFInvestor newsletter, is pushing for folks to look in the unloved, left-behind corners of the market. He’s declared, “alarm bells are ringing for me (8/27/2024).” Among the triggers:

Collectively, Microsoft, Apple, and Nvidia represent 12% of the entire global equity market.

Apple and Nvidia are both almost entirely reliant on a single product line (iPhones and data center products, respectively)

By market cap, Nvidia is valued at more than all of the stocks in the Russell 2000 index (which have 30 times Nvidia’s revenue) combined, or all of the stocks in the UK, Germany, and Canada combined.

So the people who are out of favor are way out of favor.

Where to look? We screened for funds that have earned both a FundAlarm Honor Roll designation (for outperformance over the past 3- and 5-year) periods and MFO Great Owls (for exceptional risk-adjusted performance) then sorted by Sharpe ratio (an alternate risk-adjustment tool), diversification (we won’t recommend a fund that concentrates on a single emerging market, such as Taiwan, regardless of its recent record) and accessibility.

In small value, the two top funds are Brandes Small Cap Value (BSCAX) and PIMCO RAE US Small Fund (PMJAX). Brandes is a bottom-up, contrarian value sort of operation with a small, compact portfolio and a 98.5% active share. RAE signals Research Affiliates Equity. PMJAX is a quant fund whose model overlays traditional value metrics alongside quality indicators, momentum signals, and other relevant data points and then “dynamically rebalances” as conditions evolve. Pretty consistently five-star as well as an MFO Great Owl.

| Five-year APR | APR versus peers | Risk versus peers | Ratings | |

| Brandes SCV | 17.6 | 5.0 | Low | Five star, Great Owl |

| PIMCO RAE US Small | 17.3 | 4.7 | Above average | Five star, Great Owl |

In large cap value, check any of the flavors of Fidelity Large Cap Stock (FLCSX). It’s the only large value fund to pass our screen, though it does so in several different flavors including Fidelity Series, K6, Advisor, and Regular. Mr. Fruhan has been running the strategy for 19 years. He looks for firms that exhibit strong potential for earnings and dividend growth over a two to three-year horizon. The fund aims to capitalize on perceived mispricing in the market by conducting a thorough bottom-up fundamental analysis. Our other pick, excellent in its own right, is FPA Queens Road Value (QRVLX). Mr. Scruggs pursues a sort of “quality value” strategy: he seeks high-quality firms (strong balance sheets and strong management teams) whose stocks are undervalued (based, initially, on price/earnings and price-to-cash flow metrics). They sell very rarely which is reflected in a single-digit turnover ratio.

| Five-year APR | APR versus peers | Risk versus peers | Ratings | |

| Fidelity Large Cap Stock | 16.7 | 4.7 | Average | Four star, Great Owl |

| FPA Queens Road Value | 13.7 | 1.7 | Average | Five star |

In emerging, PIMCO RAE Emerging Markets Fund (PEIFX) has the same heritage and charms as the Small Fund we discussed above. Oceans of data + a multi-layer selection screen = win. Roughly. Pretty deep-value, a pretty large cap. GQG Partners Emerging Markets Equity (GQGIX) is the flagship fund of one of the world’s most successful EM investors. Rajiv Jain has an obsessive focus on quality and a record of spectacularly successful funds. They target high-quality companies characterized by financial strength, sustainability of earnings growth, and quality of management. The goal is to manage downside risk while providing strong long-term returns.

| Five-year APR | APR versus peers | Risk versus peers | Ratings | |

| PIMCO RAE Emerging Markets Fund | 10.9 | 6.1 | Average | Five star, Great Owl |

| GQG Partners EM Equity | 9.9 | 5.1 | Low | Five star, Great Owl |

Our own preferences tend toward “high quality” and “low risk” portfolios. The screener at MFO Premium, though, would allow you to test a huge variety of investments against a huge variety of metrics across a huge variety of time frames.

Thanks, as ever …

In response to our (slightly sad) note that we’d ended our fiscal year in the red, several folks stepped up with contributions for which we’re deeply grateful. Thanks to Craig from Delaware, Lee of San Antonio, OJ, Paul from Florida, Jeroen of Anchorage (We do our best!), Michael from DMS, and of course, our regular crew, Wilson, S&F Investment Advisors, Gregory, William, William, Stephen, Brian, David, and Doug.

Thanks to George C from San Pablo for his thoughtful feedback on the “Indolent Portfolio” article in BottomLine and on some issues with how the site works for him.

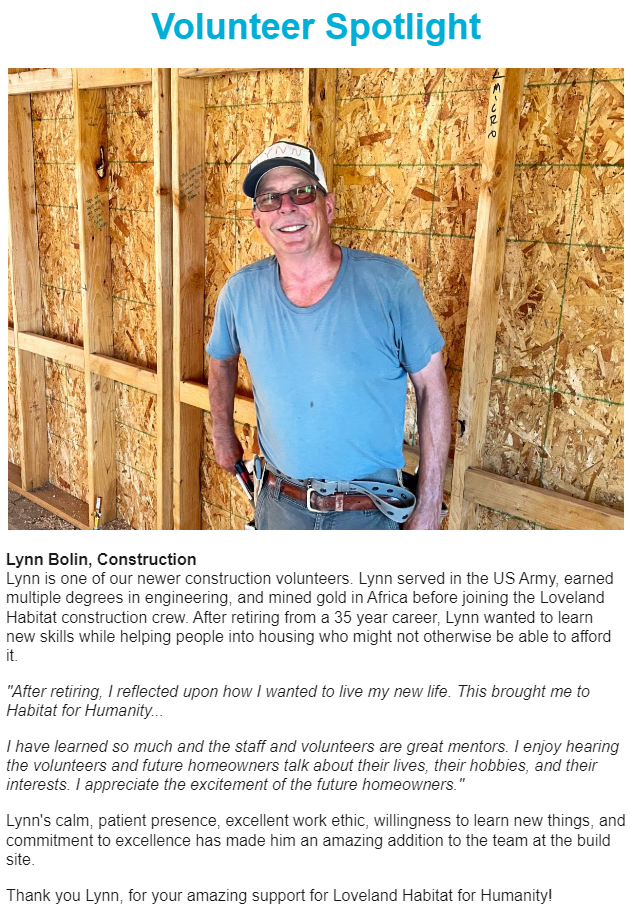

And, most especially, to our colleague Lynn Bolin. Lynn, recently retired, spends time traveling, with family and in helping the Loveland, Colorado, Habitat for Humanity. Habitat recently celebrated Lynn, and we wanted to share their brief story with you:

We made a (matched) contribution to Habitat in Lynn’s honor this month. We urge you to do likewise, either directly to Lynn’s Loveland, Colorado chapter of Habitat or to your local Habitat chapter. Better yet, follow the example set by Lynn, Jimmy Carter, Jon Bon Jovi, Garth Brooks, Trisha Yearwood, and others, pick up a hammer and make the world just a bit better.

We face exciting times. If you get a chance, smile at the next person you meet and tell them they look good. Through such small gestures, communities are built.

Take care,